Position Builder is a powerful tool for traders that allows you to easily create sophisticated portfolios using Derivatives — Perpertuals, Futures, and Options. It enables you to diversify your investments by offering a range of contracts and customized strategies and placing up to hundreds of orders in one go.

In this guide, we'll show you how to get started with Position Builder on Bybit, so you can quickly build your own trading portfolios.

Before you start using the Position Builder, please note the following:

-

Make sure your account has been upgraded to a Unified Trading Account to ensure that multiple orders can be accepted.

-

Only Market and Limit orders are currently supported.

Step 1: You can enter the Position Builder page in the following two (2) ways:

a) USDT Perpetual trading page: Click on Strategy in the order zone. Here you can explore two (2) investment strategies: Perpetual Protection and Perpetual Income Growth.

The strategies of Perpetual Protection and Perpetual Income Growth are similar to Protective Put and Covered Call, respectively. To learn more about these strategies, please check out the following articles:

Next, clicking on Purchase allows you to enter the quantity of the strategy that you want to purchase and its corresponding details. You can also click on Customize in the order zone to go to Position Builder's main page and customize your orders accordingly.

b) USDC Options trading page:

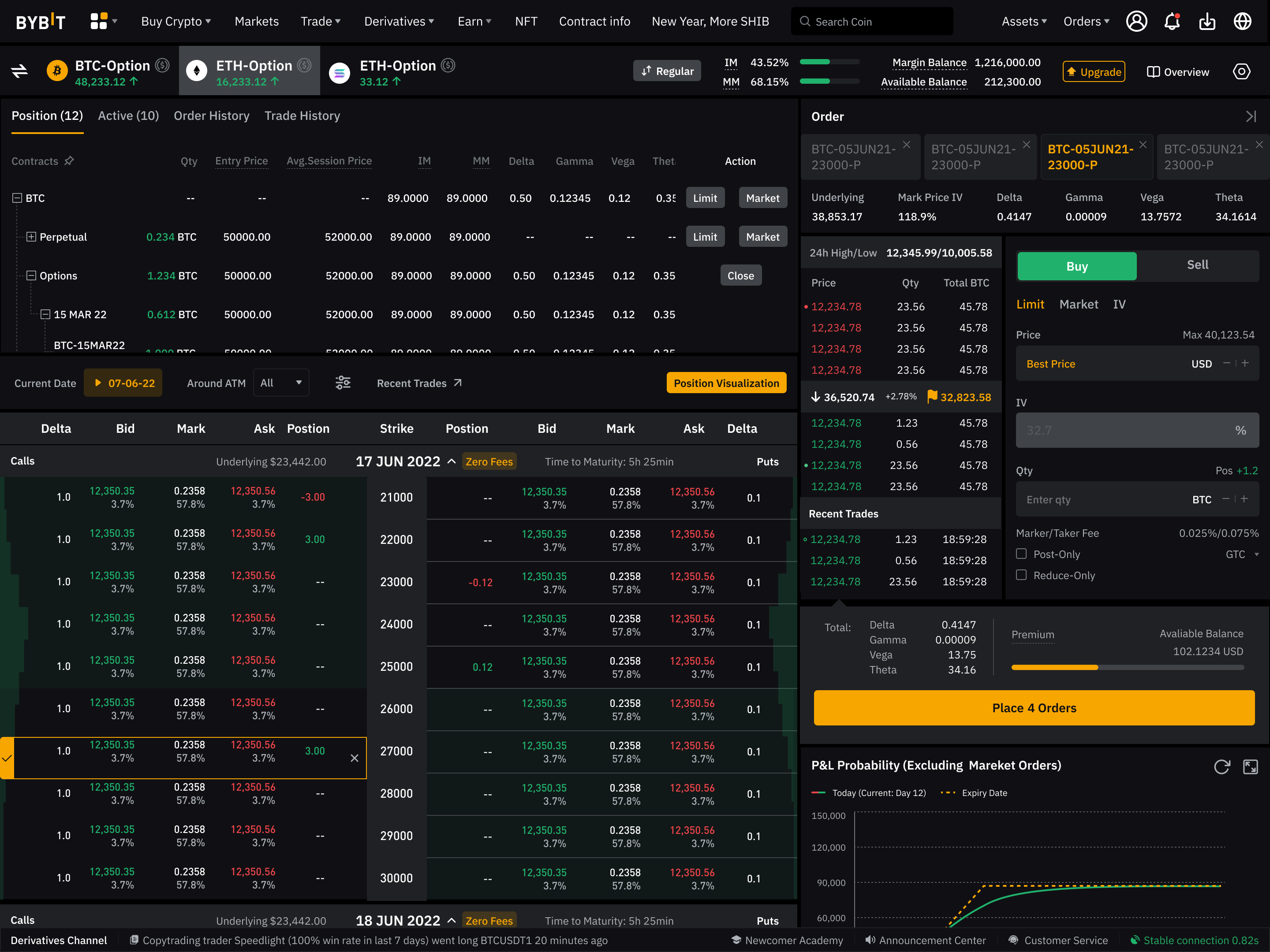

Click on Position Builder at the top right of the Options Chain.

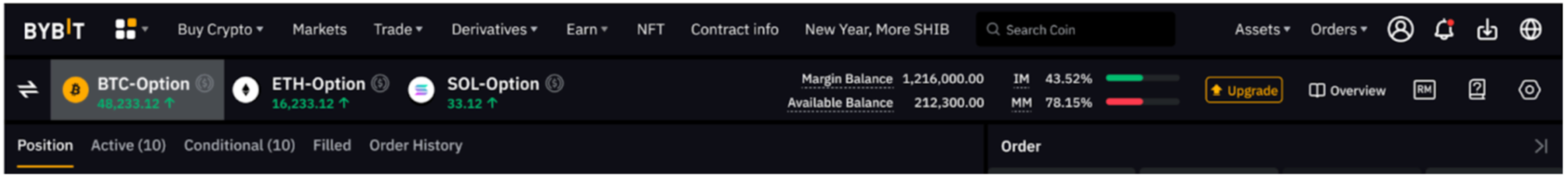

Step 2: Place your order via Position Builder.

With USDT Perpetuals, USDC Perpetuals, USDC Futures and USDC Options contracts, you can customize up to 200 positions. Plus, discover the possibilities of Straddle Strategies, Butterfly Strategies, Iron Condor Strategies, Strangle Strategies, Call/Put Spread Strategies, Covered Call Strategies and Protective Put Strategies for a variety of investment ideas in different market situations.

-

Select the coin for which you want to create a position

-

Customize and use strategy templates to build your positions:

-

Choose contracts

-

Set the type and direction of the contract

-

Add a simulated position

-

Set the leverage of the Perpetual Contract

-

Edit your preferred order price and position size

-

View the order book status

-

Choose Market or Limit order type

Note: USDT Perpetual is recommended by default. You can select other contract types from the dropdown, including USDC Perpetuals, USDC Futures and USDC Options.

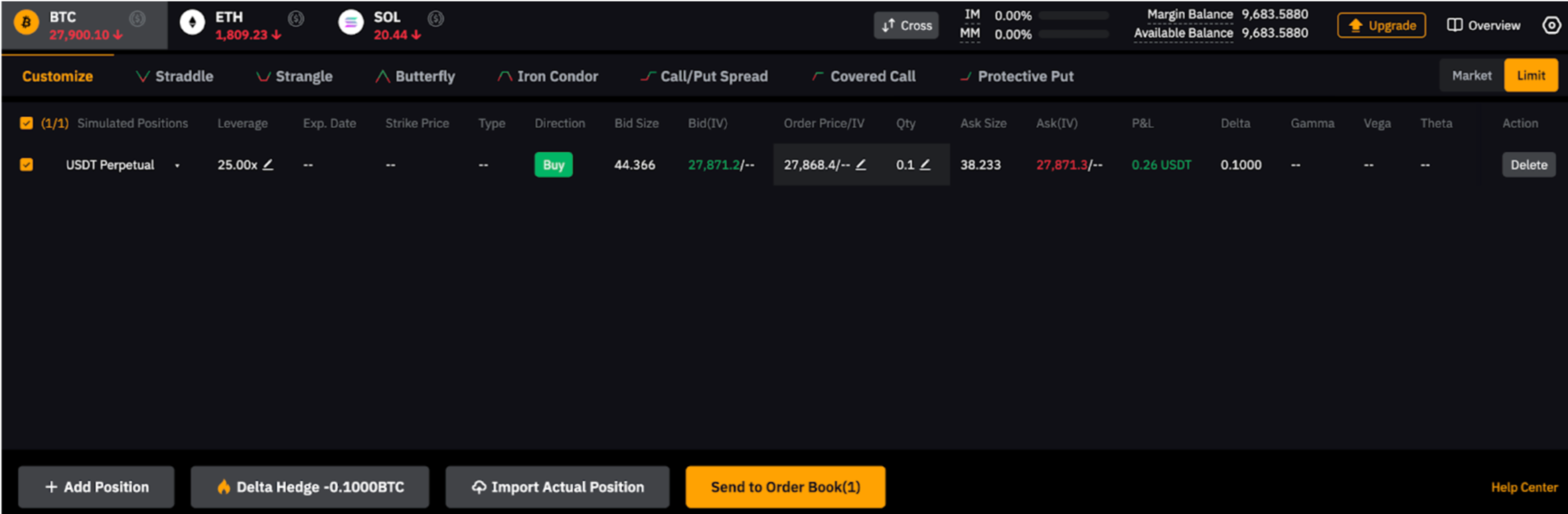

To further customize your strategies, you can take advantage of Delta Hedge. If there is a Delta exposure in your combination, the amount of hedge available will be shown and you can offset it by adding the relevant derivatives to remain Delta neutral.

In addition, the system recommends a long strategy by default. By clicking on the Change to Customize Mode, you can customize various parameters of your position such as quantity and order direction. After switching to Customize Mode, the original data of the strategy will be preserved, and you can freely edit parameters such as quantity and direction.

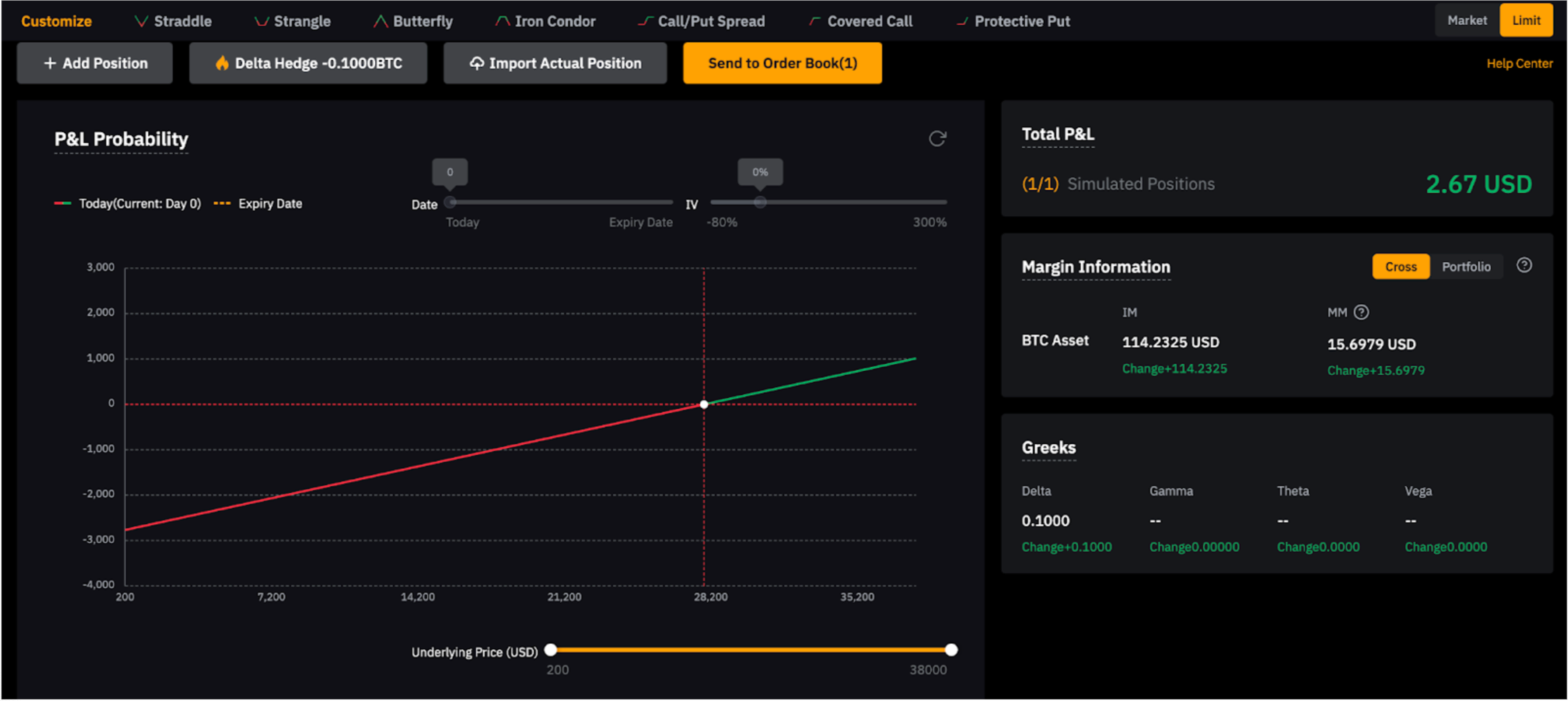

Adjust Your P&L Chart

You can use the P&L chart feature to customize your strategies in the following ways:

-

Strike Price: Select the strike price range you want to view to update the display of the P&L chart.

-

Implied Volatility (IV): Drag the IV range from -80% to 300%.

-

Expiry Date: Drag the expiry date from its current level up to the furthest expiry for an option.

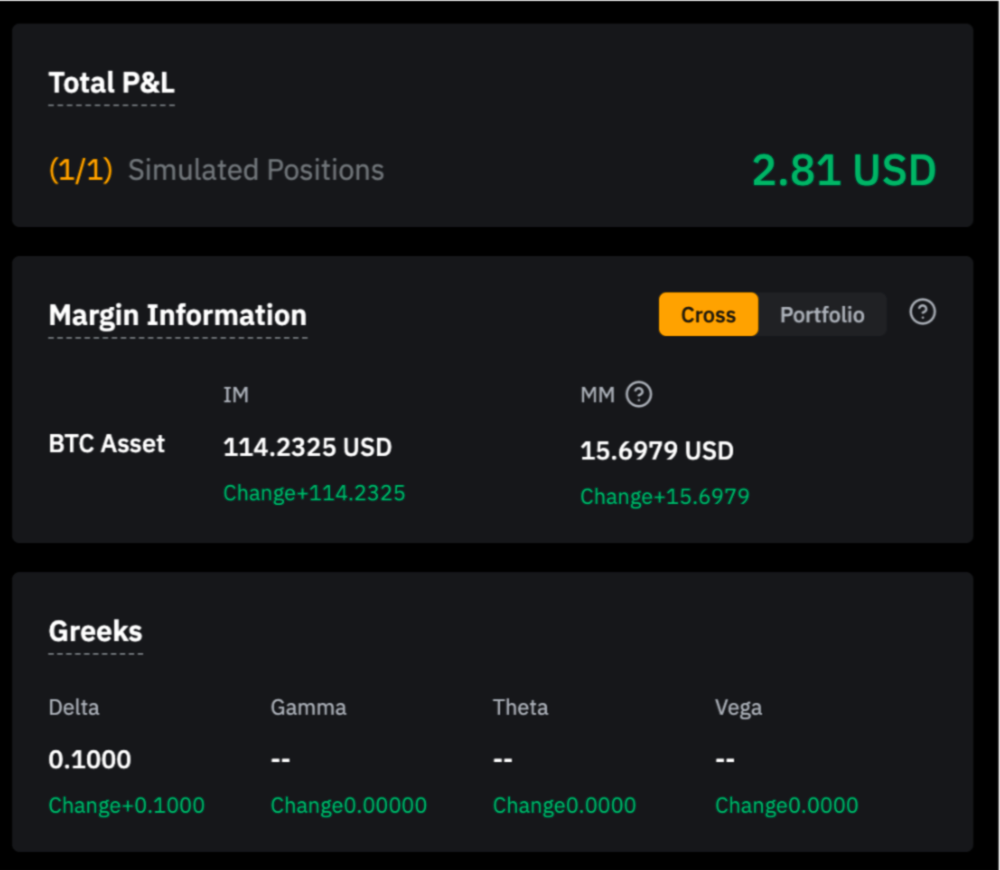

View Total P&L, Margin and Greeks

On the right side of the page, you can view various important information such as overall profit and loss of the simulated position, margin occupied, and Greek value.

Click on the Portfolio or Cross in the Margin Info to view detailed introductions of Portfolio Margin and Cross Margin and switch directly between them.

For placing orders on multiple legs with a long-short hedging relationship between contracts, it is recommended to use the Portfolio Margin Mode.